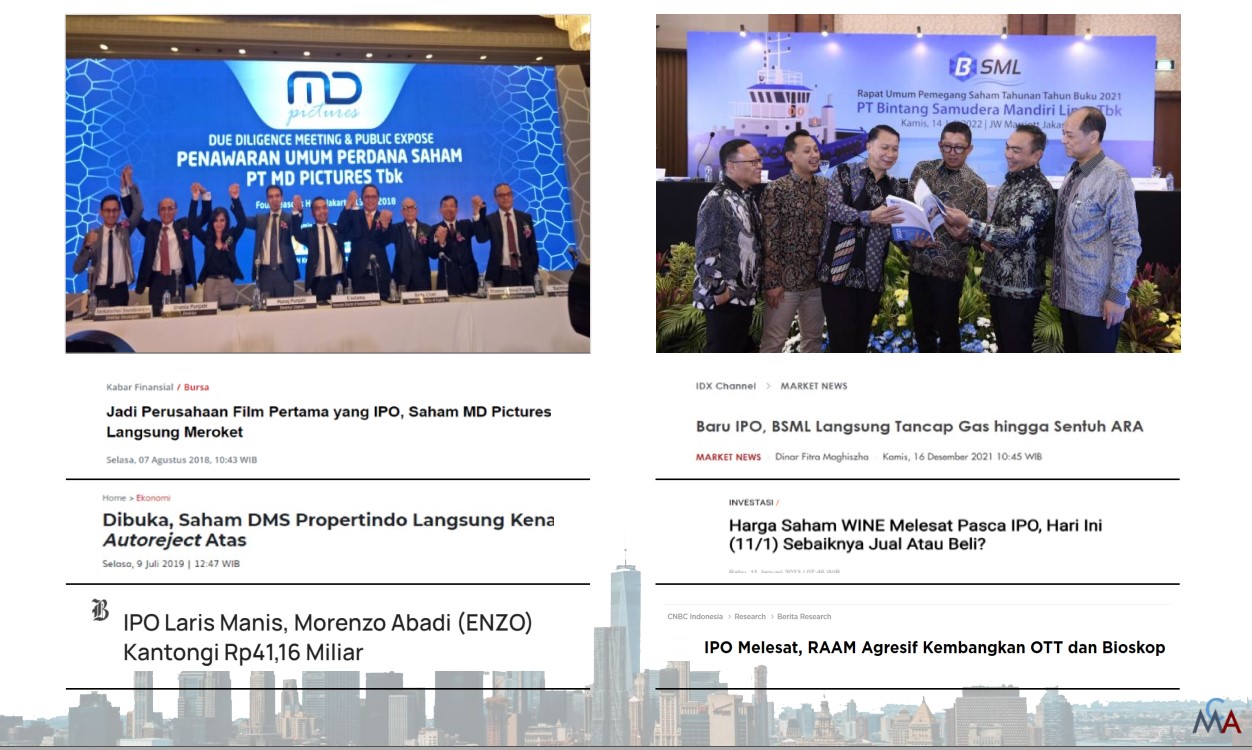

We have succesfully helped our client's in overcoming their financial challenges

getting the right advice is key for business growth and sustainability

McMillan Capital was established in 2010 as a boutique advisory firm. We have assisted various clients in their endeavors such as IPO, RTO, restructuring, mergers and acquisitions, fund raising, valuation, etc.

McMillan Capital established Goldfive Investment Capital, an investment firm which is the majority shareholder of PT. Bintang Samudera Mandiri Lines Tbk., a sea freight company that went public at the end of 2021.

getting the right advice is key for business growth and sustainability

We bring deep, specialized knowledge across various industries, backed by years of successful engagements and measurable results.

Unlike other firms that might rely on one-size-fits-all methods, we emphasizes custom solutions grounded in data analysis and tailored strategies. This approach ensures that every recommendation is based on a clear understanding of each client’s specific challenges and goals, leading to targeted improvements.

We prioritize long-term partnerships, focusing on sustainable success rather than short-term fixes. By implementing systems, upskilling teams, and offering strategic insights, we create lasting value, positioning ourselves as trusted advisors dedicated to our clients' continuous growth and impact.

To get where we are now, these skillsets are among the most important. And we posses them

We are committed to delivering exceptional service that exceeds client expectations by tailoring strategies to address each client’s unique challenges and goals. Through meticulous planning, innovative solutions, and proactive communication, we work diligently to foster long-term success and satisfaction.

Ready to elevate your business to new heights? Our expert consultants are just a phone call away. Let's discuss your unique challenges and explore innovative solutions together. Schedule a complimentary consultation today and unlock the potential of your business. Call us to get started.

Discover how we’ve transformed businesses like yours. Here’s a glimpse into our portfolio of satisfied clients.

Our team Consists Experienced in the field

Indonesian citizen, 50 years old. He earned a Master of Management degree from IPMI Business School in 2009. Previously, he earned a Bachelor of Economics from Udayana University in 1996. He holds certifications including Certified Public Accountant (CPA) from the Institute of Certified Public Accountants Indonesia since 1999, Certified Internal Auditor (CIA) from the Institute of Internal Auditors USA since 2002, Certified Valuation Analyst (CVA) from the International Association of Consultants, Valuators and Analysts, Canada since 2013, Certified Investment Banker (CIB) from the Capital Market Professional Certification Institute since 2017, and Investment Manager Representative (WMI) from The Indonesian Capital Market Institute (TICMI) since 2019. Served as Commissioner of the Company Commissioner of the Company since March 2021. He is currently also an Independent Commissioner at PT Bakrie Sumatera Plantation Tbk since 2017 and President Director at PT Goldfive Investment Capital since 2016. Previously, he served as as Associate Director at PT NH Korindo Securities (2018 – 2020), Founder of KAP Rama Wendra (since 2004), Commissioner at PT Inve Indonesia (2002 – 2014), Finance & General Manager at PT Inve Indonesia (2001 – 2002), Finance Coordinator at Schlumberger – Asia Finance Center (1999 – 2001), Accounting / Auditor at Newcrest mining Ltd (1998 – 1999), and Auditor at KAP Salaki & Salaki (1996 – 1998).

Indonesian citizen, 50 years old. He earned a Master of Management degree from IPMI Business School in 2009. Previously, he earned a Bachelor of Economics from Udayana University in 1996. He holds certifications including Certified Public Accountant (CPA) from the Institute of Certified Public Accountants Indonesia since 1999, Certified Internal Auditor (CIA) from the Institute of Internal Auditors USA since 2002, Certified Valuation Analyst (CVA) from the International Association of Consultants, Valuators and Analysts, Canada since 2013, Certified Investment Banker (CIB) from the Capital Market Professional Certification Institute since 2017, and Investment Manager Representative (WMI) from The Indonesian Capital Market Institute (TICMI) since 2019. Served as Commissioner of the Company Commissioner of the Company since March 2021. He is currently also an Independent Commissioner at PT Bakrie Sumatera Plantation Tbk since 2017 and President Director at PT Goldfive Investment Capital since 2016. Previously, he served as as Associate Director at PT NH Korindo Securities (2018 – 2020), Founder of KAP Rama Wendra (since 2004), Commissioner at PT Inve Indonesia (2002 – 2014), Finance & General Manager at PT Inve Indonesia (2001 – 2002), Finance Coordinator at Schlumberger – Asia Finance Center (1999 – 2001), Accounting / Auditor at Newcrest mining Ltd (1998 – 1999), and Auditor at KAP Salaki & Salaki (1996 – 1998).

Here are the most common questions we hear from clients and potential clients.

Our firm provides a range of services, including mergers and acquisitions, leveraged buyouts, growth equity, and restructuring.

Our fee structure typically includes a fix fee and a success fee. The fix fee is a percentage of the committed capital, while the success fee is based on the fund's realized returns.

It must follow our investment objectives, strategy, criteria, risk management practices, governance, and performance measurement standards.

For more information and queries, you can contact us here.

The Manhattan Square

Mid Tower 18th Floor

Jl. TB Simatupang Kav. 1S

Jakarta 12560

info@mcmcapital.id

+62 21 2940 7239